One of the most common mistakes new BRRRR investors make—especially in fast-moving Texas markets—is chasing equity while ignoring cash flow. Consider buying for cash flow first and equity second:

Equity looks great on paper, but cash flow is what keeps a property alive month after month. If the deal doesn’t pay for itself, the strategy breaks down no matter how much equity you’ve “created.”

This principle is simple:

Prioritize cash flow first. Treat equity as a bonus.

Why Cash Flow Comes First

Texas properties come with unique carrying costs that can quietly drain profits if you’re not prepared. Unlike many other states, Texas has:

- Higher property taxes (2025 upon writing this)

- Rising insurance premiums

- Strong tenant protections in major metros

- Rapidly shifting rental comps in high-growth areas

These factors make cash flow the true test of a BRRRR deal’s durability.

Equity can only bail you out once.

Cash flow bails you out every month.

What Buying for Cash Flow Actually Means

It’s not just about making sure the rent is higher than the mortgage. Buying for cash flow means ensuring the deal performs after all real expenses, such as:

- Property taxes (which climb in many Texas counties)

- Insurance (especially in high-wind or hail zones)

- Property management

- Maintenance and capex reserves

- Vacancy periods

- Utilities (if applicable)

A property that cash flows after these items is likely safe. A property that only cash flows on a spreadsheet is a liability.

Equity Still Matters — Just Not First

Of course equity is valuable. It helps you:

- Improve your net worth

- Pull capital out on refinance

- Create long-term wealth

- Protect yourself from market fluctuations

But equity alone doesn’t cover a surprise tax bill, a two-month vacancy, or a rising insurance premium. Texas real estate is a long game, and long games require stability.

Think of it this way:

Cash flow keeps you in the game.

Equity is how you win the game.

How to Apply This in Real Deals

Before you buy a property, ask yourself one key question:

“Would I still buy this deal if the ARV came in 10% lower—but the cash flow remained strong?”

If the answer is no, the deal relies too heavily on equity and not enough on performance.

Smart BRRRR investors in Texas use the Rent-Backwards Method:

- Start with what the property actually rents for.

- Deduct real expenses (not just estimated ones).

- See what mortgage payment the property can support.

- Work backwards to calculate your max purchase price.

- Cash flow drives the buy box—not hope, appreciation, or hypothetical equity.

In Texas investing, BRRRR deals are won or lost in the monthly numbers. Buy for cash flow first, and the equity you build becomes a powerful bonus—not a crutch. Make this your guiding principle, and your BRRRR portfolio will be durable, scalable, and profitable through any market cycle.

Ready to BRRR Texas?

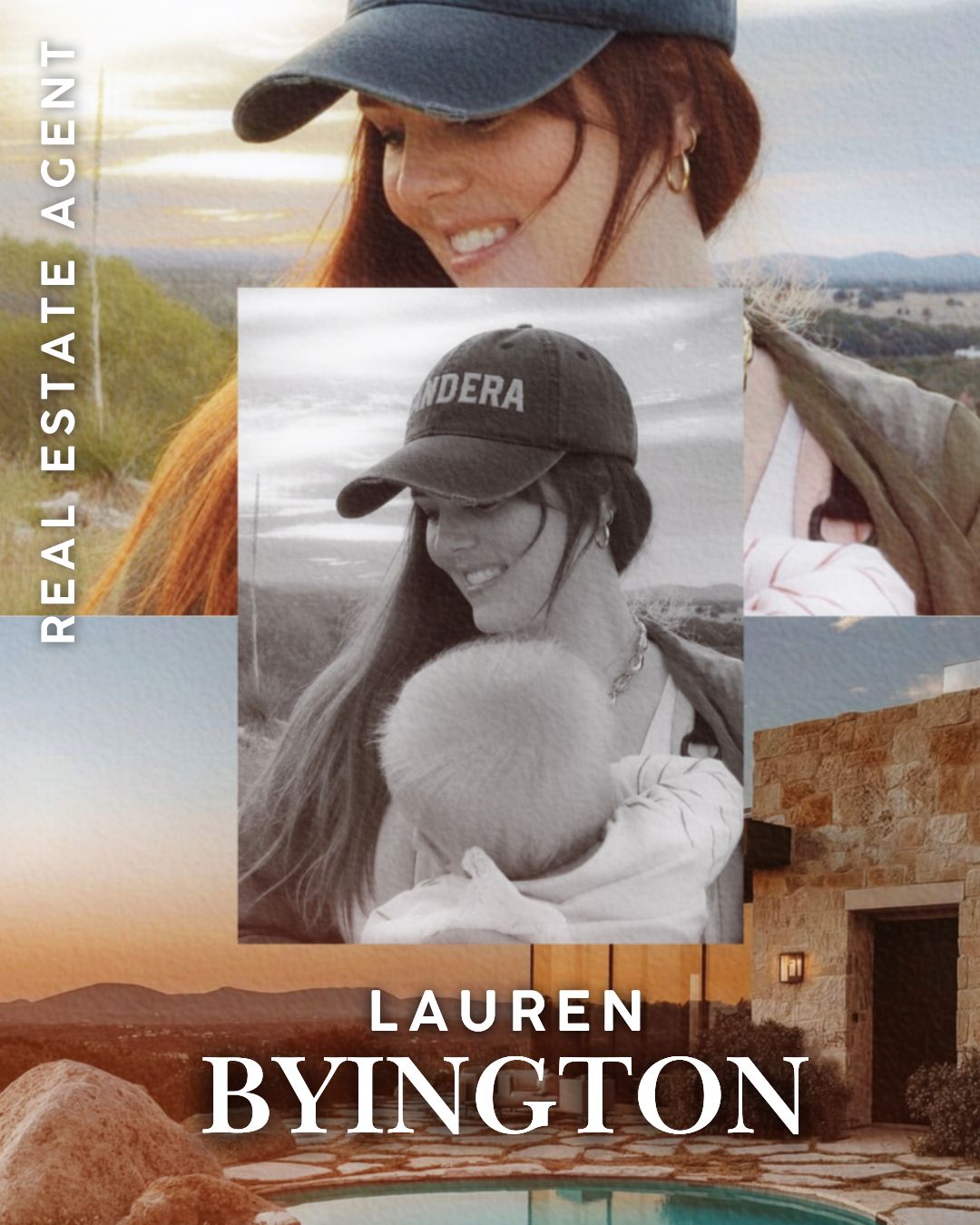

Contact Lauren Byington

Hill Country Real Estate Specialist

📧 lauren@hillcountryinsider.com

📱 830-556-1091

🌐 HillCountryInsider.com

Disclaimer: The information provided is for educational and general informational purposes only and should not be construed as financial, legal, or tax advice. Real estate markets, lending guidelines, and property values can change rapidly, and past performance is not indicative of future results. All figures, examples, and projections are estimates only. Investors and buyers should independently verify all information and conduct thorough due diligence, including but not limited to: professional inspections, contractor evaluations, surveys, appraisals, title research, and consultation with qualified legal, tax, and financial professionals. Local regulations, zoning, municipal services, and property tax rates may change based on state or local government decisions and can materially affect property performance. You are solely responsible for all investment decisions and outcomes.

0 comments