The Rent-Backwards Method flips the traditional analysis on its head. Instead of forcing rent to justify a purchase price, you let the rent determine whether the deal works at all.

Most real estate investors start a deal by asking, “How cheap can I buy this property?”

Experienced Texas BRRRR investors ask a different question:

“What can this property safely rent for?”

Why the Rent-Backwards Method Works in Texas

Texas is a landlord-friendly but cost-heavy state. High property taxes, rising insurance premiums, and local fee increases mean that guessing or hoping the numbers work is dangerous.

At the same time, many Texas investors benefit from DSCR (Debt Service Coverage Ratio) loans, where lenders care far more about property income than your personal W-2s. This makes rental performance—not purchase hype—the foundation of the deal.

If the rent works, the financing usually follows. If the rent fails, nothing else matters.

Step 1: Start With Realistic Market Rent

The method begins with conservative, verifiable rent numbers:

- Compare similar properties within the same ZIP code

- Match bed/bath count, square footage, and finish level

- Avoid using top-of-market or “future rent” assumptions

Your rent estimate should reflect what a property will lease for today, not after the market “catches up.”

Step 2: Subtract Real Expenses

Next, remove all operating costs before thinking about your mortgage:

- Property taxes (using current county rates)

- Insurance

- Property management (even if self-managing)

- Maintenance and capital reserves

- Vacancy allowance

- HOA or utility expenses

This step is where many Texas deals fall apart... and that’s a good thing. Deals that fail here would have become problems later.

Step 3: Determine the Maximum Mortgage

What’s left after expenses is the maximum debt payment the property can safely carry.

DSCR lenders typically require the rent to cover the mortgage by a specified ratio (often 1.20–1.25x), giving you a margin of safety.

This number—not the seller’s asking price—determines:

- Your maximum loan amount

- Your refinance potential

- Your cash-flow safety level

Step 4: Work Back to the Purchase Price

Once you know what mortgage payment the rent supports, you reverse-engineer the deal:

- Apply current interest rates

- Factor in lender LTV limits

- Account for rehab costs and closing expenses

- What remains is your maximum purchase price.

If the seller won’t meet it, the deal doesn’t work — and you move on without emotion.

Why This Method Prevents BRRRR Failure

The Rent-Backwards Method ensures:

- The deal works before appreciation

- Financing aligns with income, not hope

- Cash flow survives tax and insurance increases

- Refinancing is smoother with DSCR lenders

It removes guesswork, protects capital, and creates repeatable results.

In Texas BRRRR investing, rent is the engine that powers everything else. Start there, and let the math tell you what to pay, not the market noise. Investors who use the Rent-Backwards Method don’t chase deals; they filter them. And that discipline is what builds durable, scalable portfolios.

The best time to invest in Texas real estate was five years ago. The second-best time is today.

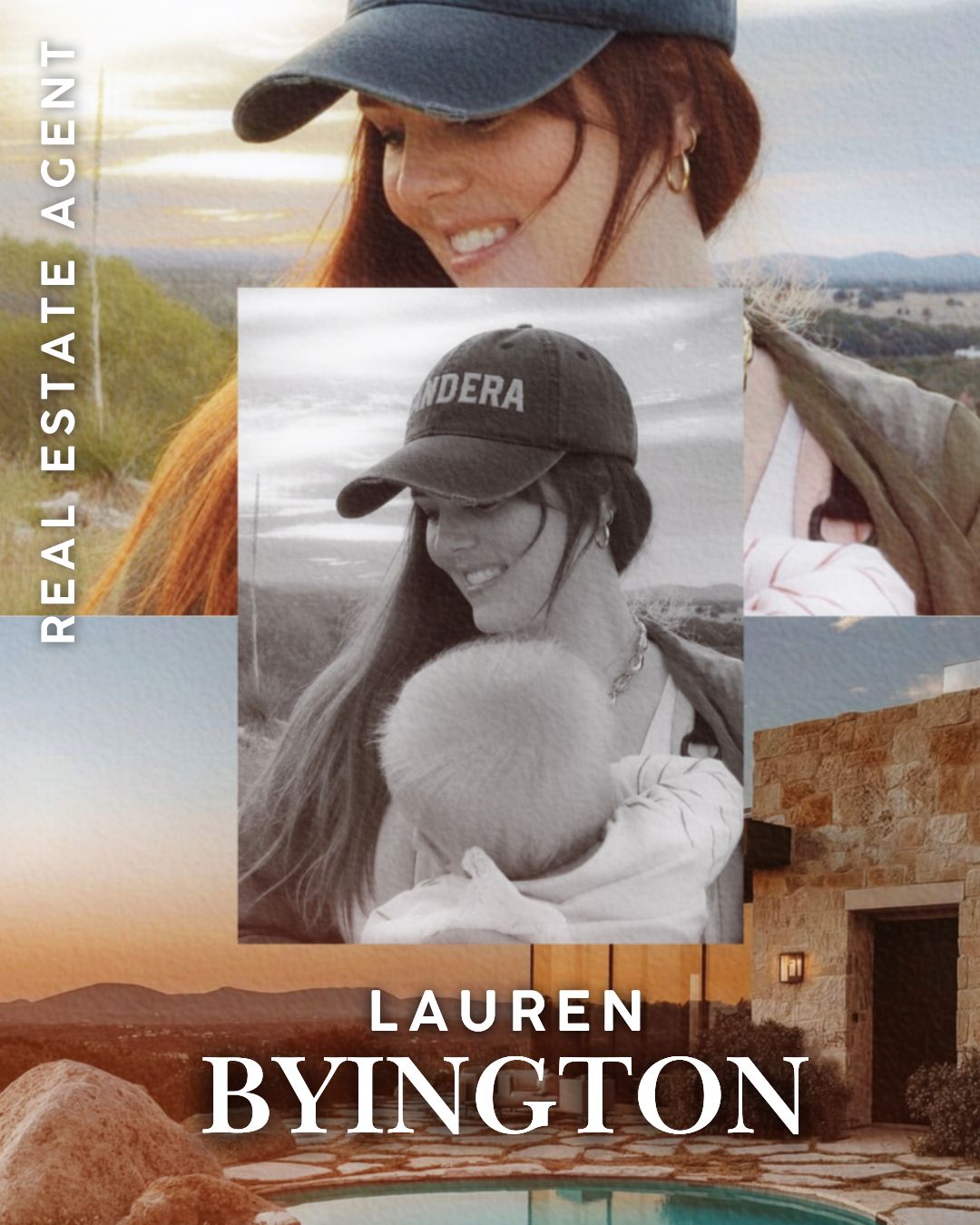

Contact Lauren Byington

Hill Country Real Estate Specialist

📧 lauren@hillcountryinsider.com

📱 830-556-1091

🌐 HillCountryInsider.com

Disclaimer: The information provided is for educational and general informational purposes only and should not be construed as financial, legal, or tax advice. Real estate markets, lending guidelines, and property values can change rapidly, and past performance is not indicative of future results. All figures, examples, and projections are estimates only. Investors and buyers should independently verify all information and conduct thorough due diligence, including but not limited to: professional inspections, contractor evaluations, surveys, appraisals, title research, and consultation with qualified legal, tax, and financial professionals. Local regulations, zoning, municipal services, and property tax rates may change based on state or local government decisions and can materially affect property performance. You are solely responsible for all investment decisions and outcomes.

0 comments