What Texas law requires sellers to disclose about deaths on properties - and what buyers need to know before they sign

"Are you aware of the prior owners?" the elderly neighbor asked, her eyes intense as she stood in my potential new kitchen. "I've never seen a death like that. The sounds... oh, the sounds. I just sat outside the room like I was asked to."

We were two weeks into the inspection period for what seemed like the perfect Hill Country property: a sprawling riverfront home with spring-fed water, scenic outbuildings, and the kind of authentic charm that brings people to this region. The asking price was reasonable, and, while the inspection reports were probably jarring to most, my husband and I were willing to undertake the project. My family was already diligently planning the investment...

Then came that conversation with the neighbor who had a disturbing habit of letting herself into the house. Yes, randomly letting herself in, whether it be the foyer, hallway, or even bedroom; on various occasions, I'd turn a corner in the old, sprawling house, and there'd be the elderly neighbor, stoically, silently petting one of my hounds.

She'd asked me twice:

"Do you know the story of this place? The prior owners?"

What should have been a routine property evaluation suddenly became a lesson in Texas disclosure laws, human psychology, and the complex reality of "stigmatized properties."

Death is part of life, and rural properties with long histories inevitably have stories. The question isn't whether these events occurred, but what sellers must legally disclose and how buyers should handle information that might affect their comfort with a property.

Understanding Texas Disclosure Requirements

Texas real estate disclosure laws focus primarily on physical property conditions rather than psychological factors. The Texas Property Code specifically addresses death-related disclosures, but the requirements are more nuanced than most people understand¹.

Under Texas law, sellers are not required to disclose deaths that occurred from natural causes, suicide, or accidents unrelated to the property's condition.

This means that if someone passed away from old age, illness, or even suicide, sellers have no legal obligation to inform buyers². The law recognizes that these events, while potentially emotionally significant to some buyers, don't affect the property's physical condition or safety.

However, murder represents a different category entirely.

The Texas Property Code doesn't explicitly exempt murder from disclosure requirements, and legal experts generally agree that homicides should be disclosed if known to the seller³. This includes murders that occurred before the current seller owned the property, as long as the seller is aware of the incident.

The distinction matters because murder falls under the Deceptive Trade Practices Act as a material fact that buyers would want to know before making a purchase decision⁴. Courts have found that deliberately concealing known murders can constitute deceptive practices, exposing sellers to potential legal liability.

The Texas Association of Realtors' Seller's Disclosure Notice includes a specific question about "deaths other than those caused by natural causes, suicide, or an accident unrelated to the property's condition"⁵. This phrasing captures murders while exempting the deaths that Texas law considers non-material to property transactions.

When Disclosure Becomes Mandatory

While sellers may not be legally required to volunteer information about certain deaths, they must answer truthfully if buyers ask direct questions. The Texas Real Estate Research Center emphasizes that sellers cannot misrepresent material information when specifically questioned⁶.

If a buyer asks "Has anyone died on this property?" or "Are there any deaths I should know about?", sellers must provide truthful answers regardless of whether the law requires voluntary disclosure. Lying in response to direct questions can result in contract cancellation, damages, or other legal consequences.

Deaths related to property conditions must always be disclosed, even if the death was accidental. For example, if someone died due to carbon monoxide poisoning from a faulty furnace, structural collapse, or other property-related causes, that information must be provided to buyers even if the dangerous condition has been corrected⁷.

The practical reality extends beyond legal requirements. The Texas Real Estate Research Center notes that neighbors often provide information about property histories whether sellers disclose or not⁸. Buyers who discover undisclosed deaths after closing may seek legal recourse, arguing that the information would have affected their purchase decision.

The Psychology of Stigmatized Properties

Research shows that approximately 50% of people would be affected by knowledge of paranormal activity or unusual deaths when making property purchase decisions⁹. This means that for half of potential buyers, a property's history could significantly impact their interest and willingness to purchase.

The psychological impact varies dramatically among individuals. Some buyers feel genuinely uncomfortable living in properties where traumatic events occurred, while others view such concerns as superstition that shouldn't affect real estate decisions. Cultural background, religious beliefs, and personal experiences all influence how people respond to property histories.

From a practical standpoint, stigmatized properties often face longer marketing times and may sell for lower prices than comparable properties without concerning histories. Real estate professionals report that properties with known violent deaths typically require 15-30% longer to sell and may sell for 3-5% less than market value¹⁰.

However, the impact isn't universal. Some buyers specifically seek properties with interesting histories, while others prioritize location, condition, and price over past events. The key is ensuring buyers can make informed decisions based on complete information.

Investigating Property Histories

Buyers concerned about property histories have several resources for independent research. Online databases like DiedInHouse.com provide death records associated with specific addresses, though accuracy and completeness vary by location and time period¹¹.

Local newspaper archives often contain information about significant events at properties, particularly in smaller communities where unusual incidents receive coverage. The Hill Country's smaller towns typically have newspapers that have covered local events for decades, creating searchable archives of community incidents.

County courthouse records may contain information about violent crimes, particularly if properties were involved in criminal investigations or court proceedings. However, these records can be difficult to navigate without legal assistance.

Perhaps most reliably, longtime neighbors often possess detailed knowledge about property histories. While this information may not always be accurate, neighbors can provide context about events that official records might not capture.

Real estate agents with extensive local experience might become aware of property histories through years of community involvement. Agents who specialize in specific areas might know which properties have concerning histories and can guide buyers toward appropriate disclosure requests.

The Practical Impact on Property Values

Insurance considerations can also affect stigmatized properties. While insurance companies typically don't adjust rates based on property histories, some buyers may face challenges obtaining certain types of coverage if properties are perceived as higher-risk due to previous incidents.

Financing can occasionally be affected if lenders have concerns about property marketability or resale value. However, most conventional lenders focus on property condition and borrower qualifications rather than property histories when making lending decisions.

The rental market can be particularly challenging for stigmatized properties. Tenants may be more sensitive to property histories than buyers, and landlords may face additional disclosure obligations depending on local regulations and lease terms.

Long-term marketability often improves as time passes and community memory fades. Properties that experienced traumatic events decades ago typically face fewer marketing challenges than those with recent incidents.

Disclosure Strategies for Sellers

Sellers dealing with properties that have concerning histories face complex decisions about disclosure timing and methods. Legal experts generally recommend erring on the side of full disclosure to avoid potential legal complications and relationship problems with buyers¹².

Early disclosure often proves more effective than waiting for buyers to discover information independently. Buyers who learn about property histories from neighbors or independent research may feel deceived even if sellers weren't legally required to disclose the information.

The disclosure method can affect buyer reactions. Simply checking a box on disclosure forms without context may create more concern than providing brief, factual explanations that put events in perspective.

Professional consultation becomes valuable for properties with complex histories. Real estate attorneys can help sellers understand disclosure obligations and develop appropriate strategies for handling sensitive information.

Some sellers choose to price properties slightly below market value to compensate for potential buyer concerns about property histories. This approach can attract buyers who prioritize value over concerns about past events.

Marketing approaches may need adjustment for stigmatized properties. Rather than avoiding the issue, some sellers find success working with agents who specialize in unique properties and understand how to appropriately market properties with challenging histories.

Buyer Protection Strategies

Buyers concerned about property histories should ask direct questions early in the purchase process rather than assuming sellers will volunteer all relevant information. Specific questions about deaths, violent crimes, or unusual incidents require truthful answers from sellers.

Professional property research can provide additional peace of mind. Some buyers hire private investigators or research specialists to investigate property histories before making significant financial commitments.

Contract contingencies can protect buyers who discover concerning information during due diligence periods. Including broad discovery contingencies allows buyers to cancel contracts if they learn information that affects their comfort with the property.

Insurance research becomes important for buyers concerned about property histories. Understanding coverage limitations and exclusions helps buyers make informed decisions about potential risks and costs.

Community integration considerations may affect buyer decisions. Some buyers find that neighbors' attitudes about property histories affect their comfort level and integration into local communities.

When the Past Meets the Present

The riverfront property that started this discussion never made it to closing. Not because of the disclosure issue - Texas law didn't require the seller to volunteer information about the previous owner's death - but because, sadly, we learned about multiple points of dishonesty on the seller's disclosure regarding the structural integrity of the buildings.

That experience reinforced an important lesson about rural property purchases:

Legal requirements and personal comfort don't always align. Buyers need to understand both their legal rights and their personal preferences when evaluating properties with complex histories.

The Hill Country's long history means many properties have stories. Most are benign - families who lived, loved, and eventually passed on, leaving behind homes that have sheltered generations. Occasionally, properties have more difficult histories that affect how current owners feel about their homes.

Making Informed Decisions

Understanding Texas disclosure laws helps both buyers and sellers navigate property transactions involving potentially sensitive histories. While sellers aren't required to disclose many types of deaths, they must answer truthfully when asked directly and should always disclose violent crimes.

Buyers who have concerns about property histories should ask specific questions and consider independent research. Most Hill Country properties have benign histories, but asking direct questions ensures buyers have the information they need to make comfortable decisions.

The goal isn't to avoid all properties with histories - that would eliminate many beautiful Hill Country homes with decades or centuries of stories. Instead, the goal is ensuring buyers have complete information to make decisions that align with their comfort levels and long-term happiness.

For sellers, transparency often proves the best policy even when disclosure isn't legally required. Buyers who discover information after closing may feel deceived regardless of legal requirements, potentially affecting long-term relationships and referrals.

Ultimately, successful property transactions require honest communication about factors that might affect buyer decisions. Whether legally required or not, providing information that helps buyers make informed, comfortable decisions benefits everyone involved in the transaction.

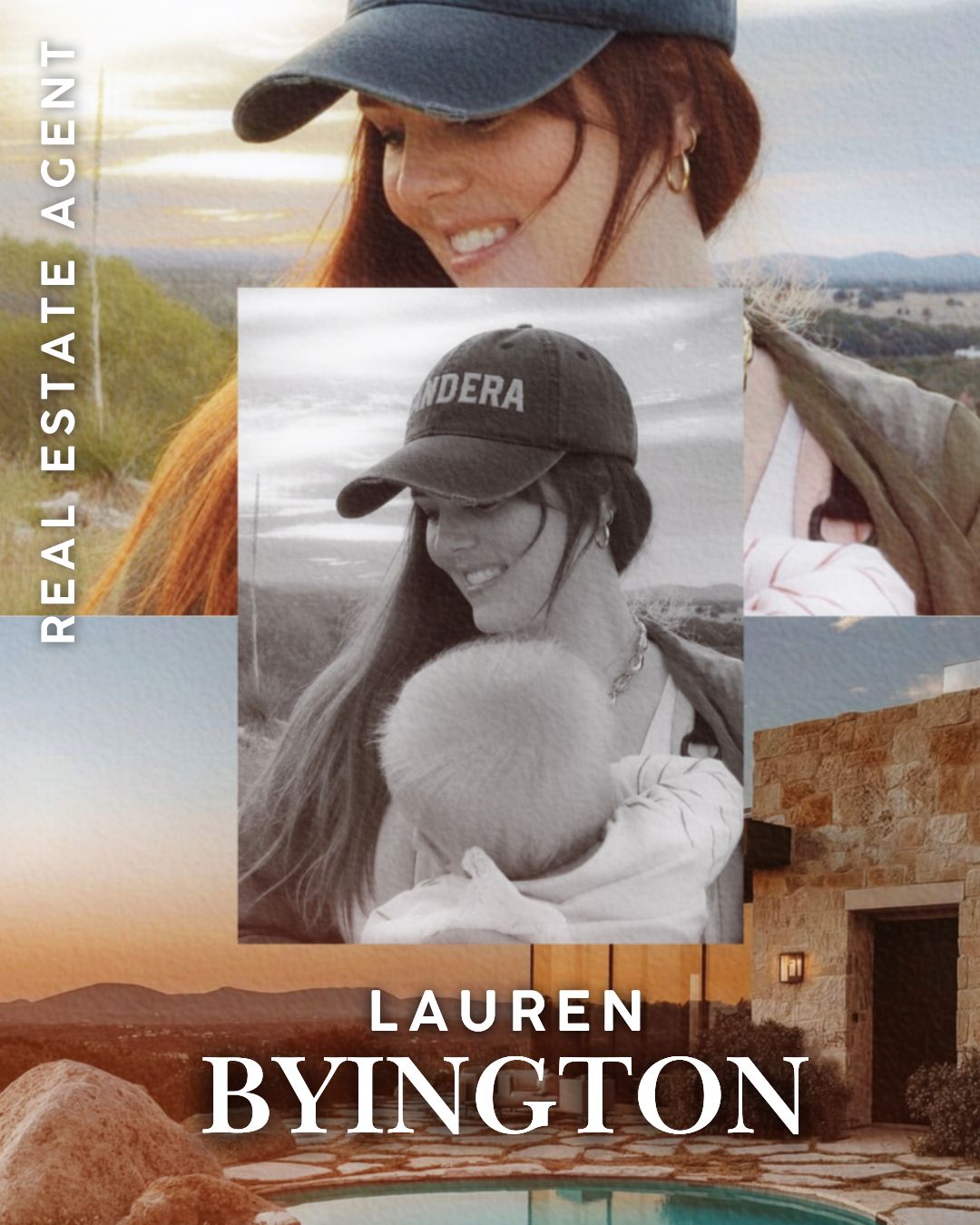

Lauren Byington is a licensed real estate professional specializing in Hill Country properties.

Contact Lauren Byington

Hill Country Real Estate Specialist

📧 lauren@hillcountryinsider.com

📱 830-992-9914

🌐 HillCountryInsider.com

Legal Disclaimer: This information is for educational purposes and should not replace professional legal advice. Texas disclosure laws are complex and may change. Property histories, disclosure requirements, and legal obligations vary by specific circumstances. Always consult with qualified real estate attorneys and professionals before making property decisions. Information is deemed reliable but not guaranteed. Individual situations may require specific legal guidance beyond general disclosure requirements.

References:

- Texas Property Code, Section 5.008, "Seller's Disclosure Notice"

- Texas Real Estate Research Center, "Death & Disclosure," 2024

- Texas Association of Realtors, "Disclosure Requirements," 2023

- Texas Deceptive Trade Practices Act, Business & Commerce Code

- Texas Association of Realtors, "Seller's Disclosure Notice Form," 2023

- Texas Real Estate Research Center, "Material Facts and Disclosure," 2024

- Texas Property Code, Section 5.008(c)

- Texas Real Estate Research Center, "Death & Disclosure Analysis," 2024

- Spaulding Decon, "Real Estate Death Disclosure by State," 2024

- National Association of Realtors, "Stigmatized Property Market Impact," 2023

- DiedInHouse.com, "Property Death Records Database," 2024

- Silberman Law Firm, "Disclosure Requirements in Texas," 2024

0 comments