Septic issues, foundation problems, and electrical nightmares - here are the warning signs that could save you thousands when buying Hill Country properties

Rural property purchases involve significantly more complex systems and regulations than suburban homes, and the costs of getting things wrong can be devastating. The good news? Most expensive surprises are preventable if you know what to look for and understand the unique challenges of Hill Country properties.

Understanding these risks before you make an offer can save you tens of thousands of dollars and months of frustration.

Hill Country's Unique Challenges

Our region sits on the Edwards Plateau, characterized by limestone bedrock, expansive clay soils, and varying water table depths². These geological factors directly impact everything from foundation stability to well drilling costs.

Climate patterns add another layer of complexity. The National Weather Service classifies much of the Hill Country as "Flash Flood Alley" due to rapid runoff from limestone terrain³. Properties that look perfect during dry conditions can become problematic during our intense storm seasons.

Additionally, our region experiences significant drought cycles that affect well production and septic system performance. While it hasn't happened to mine, I've known people whose wells have gone bone-dry.

The regulatory environment has become increasingly complex. The Texas Commission on Environmental Quality has tightened septic system regulations⁴, while local counties implement new restrictions on well drilling and development. What was permissible five years ago may not be allowed today, creating potential compliance issues for existing properties.

Rural properties also face unique insurance challenges. The Texas Department of Insurance reports that rural properties cost an average of 35% more to insure than suburban homes⁵, with additional exclusions for common rural risks like wildfire, flood, and wind damage. Understanding these costs upfront prevents budget surprises later.

Septic System Failures: The Silent Budget Killer

Most Hill Country properties rely on private septic systems instead of municipal sewer connections. The Texas Commission on Environmental Quality oversees septic system regulations, and recent changes have made replacement significantly more expensive and complex⁴.

Modern septic systems in the Hill Country typically cost between $10,000 and $35,000 to install, depending on soil conditions and system complexity. However, the real challenge lies in Hill Country's rocky terrain and clay soils. The Texas A&M AgriLife Extension reports that expansive clay soils, common throughout our region, can cause septic system failures within 10-15 years⁶.

When touring properties, septic problems often hide beneath the surface. A system may appear functional during a brief visit but fail catastrophically weeks after purchase.

I've learned to identify the subtle warning signs that indicate expensive problems ahead...

Slow drains throughout the house often signal septic system capacity issues rather than simple plumbing problems. When multiple fixtures drain slowly, especially after heavy use, the septic system likely can't handle the home's waste volume. This becomes particularly problematic if you're planning to host guests or work from home with increased water usage.

Unusually green grass over the drain field area indicates sewage breakthrough to the surface. While homeowners sometimes view this as a positive sign of good fertilization, it actually signals system failure. Raw sewage reaching the surface creates health hazards and environmental violations that require immediate correction.

Standing water or soggy areas near the septic field, especially during dry periods, indicate system failure. Properly functioning septic systems should absorb wastewater completely underground. Surface water suggests the drain field has reached capacity or failed entirely.

The financial implications extend beyond simple replacement costs. Failed septic systems create environmental violations that can result in fines from the Texas Commission on Environmental Quality⁴. If sewage reaches groundwater or surface water, remediation costs can exceed $50,000. Properties with environmental violations also face significant challenges obtaining financing and insurance.

Recent regulatory changes have made septic replacement even more complex. New systems must meet current soil percolation requirements, which may be different from when the original system was installed. Some properties that had functioning septic systems may not qualify for replacement under current regulations, creating potentially unbuildable situations.

Well Water Complications: More Than Just Water Flow

Private wells serve most Hill Country properties, and well-related issues represent some of the most expensive and complex problems rural buyers face...

The Texas Water Development Board oversees groundwater regulations⁷, while local groundwater conservation districts implement specific restrictions that vary by county.

Understanding your property's water situation requires investigating multiple factors beyond simple flow rate. Well depth significantly affects reliability and cost. The Texas Water Development Board reports that wells in the Hill Country range from 100 feet to over 800 feet deep⁷. Shallow wells may produce adequate water during normal conditions but fail during drought periods, which occur regularly in our region.

Water quality issues can be equally expensive to address. The Texas Department of State Health Services requires testing for bacteria, nitrates, and other contaminants in private wells⁸. However, Hill Country's limestone geology can create unique water quality challenges including high mineral content, pH imbalances, and hydrogen sulfide contamination that require expensive treatment systems.

Well ownership verification represents a critical but often overlooked issue. Some rural properties rely on wells located on neighboring properties through informal agreements that may not transfer with property ownership. Others share wells through legal agreements that create ongoing obligations and potential conflicts. I've seen property purchases fall through when buyers discovered their "private" well was actually shared with three neighboring properties.

The regulatory environment for new well drilling has become increasingly restrictive. Bandera County, for example, now requires minimum acreage for new well installations and restricts drilling in certain areas⁹. If your existing well fails and you can't meet current requirements for replacement, your property could become unbuildable or require expensive connection to municipal water systems that may not be available.

Pump and pressure tank systems add another layer of complexity and expense. Well pumps typically last 8-15 years, depending on usage and water quality. Replacement costs range from $3,000 to $12,000, depending on well depth and pump requirements. Properties with deep wells or poor water quality may require more frequent pump replacement and specialized equipment.

Recent drought conditions have highlighted well reliability issues throughout the Hill Country. The Edwards Aquifer Authority reports declining water levels in many areas¹⁰, which can affect well production and require expensive well deepening or replacement. Properties that had adequate water production five years ago may struggle during current drought conditions.

Foundation Problems in Expansive Clay Soils

Hill Country's geological characteristics create unique foundation challenges that don't exist in other regions. While our area sits primarily on limestone bedrock, many properties have expansive clay soils that shift dramatically with moisture changes. The Texas A&M Engineering Extension Service identifies expansive clay soils as the leading cause of foundation damage in Texas¹¹.

Expansive clay soils can move vertically up to six inches or more between wet and dry conditions. This movement creates ongoing stress on foundations, particularly slab-on-grade construction common in rural homes. Unlike suburban developments where soil conditions are typically analyzed and addressed during construction, many rural properties were built without proper soil testing or foundation design.

Foundation problems in rural areas cost significantly more to repair than suburban properties due to access limitations and specialized contractor requirements. Equipment access on rural properties often requires special arrangements, and contractors may charge premium rates for remote locations. I've seen foundation repair estimates range from $15,000 for minor pier adjustments to over $80,000 for major foundation replacement on rural properties.

Identifying foundation problems during property tours requires understanding subtle warning signs that indicate serious structural issues. Doors that stick or don't close properly often indicate foundation movement rather than simple settling. This becomes particularly concerning when multiple doors throughout the house exhibit similar problems.

Cracks in exterior brick or stone masonry, especially stair-step patterns following mortar joints, signal significant foundation movement. While small settling cracks are normal in any structure, extensive cracking or patterns that follow structural lines indicate ongoing problems that will worsen over time.

Windows that bind or refuse to open and close smoothly often reflect foundation movement affecting the structural frame. This problem becomes more expensive when it affects multiple windows throughout the house, indicating systematic foundation issues rather than isolated problems. I personally experienced this with a sprawling riverfront home that had an... interesting... past attached to it.

Interior wall cracks, particularly around door frames and corners, suggest foundation movement affecting the home's structural integrity. Fresh paint or recent repairs in these areas may indicate sellers attempting to conceal ongoing problems rather than address underlying causes.

Uneven floors or visible sagging represent serious structural concerns that require immediate professional evaluation. These problems often indicate not just foundation issues but potential structural damage that can be extremely expensive to correct.

The insurance implications of foundation problems can be as significant as repair costs. Many insurance companies exclude coverage for foundation damage caused by soil movement, particularly in areas known for expansive clay soils. Properties with documented foundation problems may face difficulty obtaining coverage or significantly higher premiums.

Electrical System Inadequacies and Safety Hazards

Rural properties often have electrical systems that were adequate when installed but can't handle modern demands. The National Electrical Code has evolved significantly over decades, and many Hill Country properties have electrical systems that were legal when installed but don't meet current safety standards¹².

The increasing prevalence of remote work has dramatically increased electrical demands in rural properties. Home offices, video conferencing, and high-speed internet equipment require reliable electrical service that many older rural properties can't provide. Additionally, modern appliances and HVAC systems often exceed the capacity of older electrical panels.

Identifying electrical problems during property tours requires understanding both safety hazards and capacity limitations. Fuse boxes instead of circuit breakers indicate electrical systems installed before modern safety standards. While fuse boxes can function safely, they lack the convenience and safety features of modern circuit breaker panels and may not provide adequate protection for today's electrical loads.

Extension cords used as permanent wiring solutions represent serious safety hazards and code violations. This practice, unfortunately common in rural properties, creates fire risks and indicates electrical systems that can't handle current demands. Properties requiring extensive extension cord use for basic electrical needs will require expensive electrical upgrades.

Flickering lights or frequently tripping breakers indicate electrical systems operating at or beyond capacity. While these problems may seem minor, they signal underlying issues that can lead to equipment damage, fires, or complete electrical failure. The National Fire Protection Association reports that electrical problems cause 13% of home fires annually¹³.

Two-prong outlets throughout the house indicate absence of proper grounding, a safety feature required in all modern electrical installations. While older homes may have been legally built without grounding, today's electronics and appliances require proper grounding for safe operation and warranty coverage.

Aluminum wiring, common in construction during the 1960s and 1970s, presents ongoing safety concerns. The Consumer Product Safety Commission identifies aluminum wiring as a fire hazard that requires special maintenance and connection techniques¹⁴. Properties with aluminum wiring often require expensive upgrades to meet current safety standards and insurance requirements.

DIY electrical work without proper permits creates multiple problems for property buyers. Unpermitted electrical work may not meet code requirements, can create safety hazards, and may void insurance coverage. Additionally, unpermitted work can complicate property sales and financing.

Bringing rural electrical systems up to current code requirements often involves more than simple updates. Service panel upgrades typically cost $3,000 to $10,000, depending on amperage requirements and connection complexity. Whole-house rewiring can cost $15,000 to $40,000 on rural properties, depending on accessibility and complexity.

Some rural properties may require utility company involvement for electrical service upgrades. Properties with inadequate electrical service from the utility company may need expensive service upgrades before electrical improvements can be made. These costs can add $5,000 to $20,000 to electrical upgrade projects.

Secondary Structure Challenges: Barns and Outbuildings

Rural properties typically include barns, workshops, and other outbuildings that represent significant value and potential liability. These structures often receive less maintenance attention than main houses but can harbor expensive problems that affect property value and insurance coverage.

Many rural property buyers focus exclusively on the main house during inspections, overlooking secondary structures that may require expensive repairs or replacement. A deteriorating barn or unsafe workshop can cost tens of thousands of dollars to repair or replace and may create insurance coverage issues.

Structural integrity problems in barns and outbuildings often develop gradually and may not be immediately obvious during casual inspection. Sagging rooflines indicate structural problems that can progress to complete failure. Metal roofing systems, while durable, can fail suddenly when fasteners corrode or structural support becomes inadequate.

Foundation problems in outbuildings can be as expensive as main house foundation issues. Many barns and workshops were built with minimal foundations that may not withstand soil movement or moisture changes. Poor drainage around outbuildings accelerates foundation deterioration and can undermine structural integrity.

Electrical systems in outbuildings often represent serious safety hazards. Many barns and workshops have electrical installations that don't meet code requirements or have been modified unsafely over time. Older outbuildings may have electrical systems that present fire hazards or shock risks.

Insurance companies increasingly scrutinize outbuildings when evaluating rural properties for coverage. Deteriorating or unsafe outbuildings can result in coverage exclusions or policy cancellation. Some insurance companies require outbuilding repairs or removal as a condition of coverage.

The cost of outbuilding repairs or replacement on rural properties often exceeds expectations due to access limitations and specialized construction requirements. A barn that appears to need simple roof repair may actually require complete reconstruction if structural problems are discovered.

Environmental and Health Hazards: Oak Wilt and Beyond

The Hill Country faces several environmental challenges that can significantly impact property values and ownership costs. Oak wilt represents the most visible and expensive environmental issue affecting our region, but other environmental factors can create substantial financial obligations for property owners.

Oak wilt disease has devastated Hill Country live oak populations and continues spreading throughout the region. The Texas A&M Forest Service reports that oak wilt affects over 76 counties in Texas, with the Hill Country experiencing some of the most severe impacts¹⁵. This disease directly affects property values through tree loss and ongoing management costs.

Understanding oak wilt's financial implications requires recognizing both immediate and long-term costs. Professional removal of infected oak trees costs $3,000 to $8,000 per large tree, depending on location and complexity. Properties with extensive oak wilt damage may require removal of dozens of trees, creating removal costs exceeding $50,000.

Prevention treatments for healthy oak trees can cost $200 to $500 per tree annually, depending on tree size and treatment method. While prevention costs less than removal, properties with numerous oak trees face substantial ongoing expenses to prevent disease spread.

The aesthetic and property value impacts of oak wilt extend beyond immediate removal costs. Mature live oaks can add $10,000 to $25,000 or more to property values. Losing multiple mature trees to oak wilt can reduce property values by $50,000 to $100,000 or more, particularly on properties where trees represent primary landscaping features.

Insurance considerations related to oak wilt continue evolving. Some insurance companies exclude coverage for oak wilt-related tree removal or property damage. Others may require preventive treatments or specific management practices as conditions of coverage.

Identifying oak wilt during property tours requires understanding disease symptoms that may not be immediately obvious. Live oaks dropping leaves rapidly during spring or summer, rather than normal fall leaf drop, often indicate oak wilt infection. Leaves turning brown from the edges inward in a distinctive pattern suggest disease rather than drought stress.

Dead or dying oak trees in clusters indicate oak wilt spread through root systems. The disease can travel between connected root systems, affecting multiple trees simultaneously. Recent tree removal scars without proper treatment may indicate ongoing disease issues that could affect remaining trees.

Beyond oak wilt, other environmental factors can create substantial costs for Hill Country property owners. Wildfire risk has increased throughout the region due to drought conditions and changing vegetation patterns. The Texas A&M Forest Service reports increasing wildfire frequency and intensity in the Hill Country¹⁶.

Properties in wildfire-prone areas face higher insurance costs and may require expensive defensible space management. Creating and maintaining defensible space can cost thousands of dollars annually and may require removing desirable vegetation or trees.

Flood and drainage issues represent another significant environmental concern. The National Weather Service identifies the Hill Country as "Flash Flood Alley" due to rapid runoff characteristics³. Properties in flood-prone areas face not only immediate safety concerns but also insurance complications and potential building restrictions.

FEMA flood maps may not accurately reflect flood risks on rural properties, particularly in areas where development has changed drainage patterns. Historical flooding information from neighbors and local emergency management officials often provides more accurate risk assessment than official flood maps.

Regulatory Compliance and Permitting Issues

The regulatory environment for rural properties has become increasingly complex, with new restrictions and requirements that can affect property use and development potential. However, one advantage of rural Hill Country properties is that building permits aren't always required for modifications and additions, particularly in unincorporated areas outside city limits.

This permitting flexibility can be a significant advantage for property customization and improvements. Many rural property owners appreciate the freedom to modify their properties, add outbuildings, or make improvements without navigating complex permitting processes that can add months and thousands of dollars to projects in suburban areas.

However, the absence of required permits doesn't mean structures are automatically safe or properly built. When evaluating properties with unpermitted additions or modifications, the key question isn't whether permits were required, but whether the work was done safely and meets basic structural standards.

Understanding permit requirements by location:

- Unincorporated county areas: Many modifications don't require permits

- City limits: Full permitting typically required for any structural changes

- Utility districts: May have specific requirements for certain improvements

- Flood plain areas: May require permits regardless of location

The advantage of permit-free customization: Rural properties often allow owners to customize their properties extensively without the delays and costs associated with permit processes. This flexibility enables everything from workshop additions to barn conversions that would require expensive permitting in suburban areas.

When to seek professional evaluation: Even when permits weren't required, having a structural engineer or qualified contractor evaluate unpermitted work provides peace of mind about safety and structural integrity. This is particularly important for:

- Structural modifications or additions

- Electrical work, especially involving main panels or high-voltage systems

- Major plumbing changes affecting septic or well systems

- Modifications to load-bearing structures

A structural engineer can assess whether unpermitted work meets basic safety standards, even if formal permits weren't required. This evaluation costs $500-1,500 but can identify potential safety issues and provide documentation for insurance purposes.

Building code compliance represents a common issue on some rural properties where structures may have been modified without consideration of basic safety principles. While permits may not have been required, understanding whether work was done safely protects your investment and family.

Bringing questionable structures into compliance or improving them can sometimes be less expensive in rural areas where permit requirements are minimal. However, some modifications that were legal when built may not meet current safety standards, creating situations where improvements require more extensive work than originally planned.

Insurance and financing considerations: Even when permits weren't required for construction, insurance companies and lenders may require documentation that work was done safely. Professional evaluation of unpermitted work can provide this documentation and prevent coverage or financing issues.

Some lenders require professional evaluation of any unpermitted structures as a condition of financing, regardless of whether permits were originally required. Having this evaluation completed before listing or purchasing can prevent delays in transactions.

Septic system regulations have become more stringent, with new requirements that may affect existing systems. The Texas Commission on Environmental Quality has implemented new standards that can make septic system replacement more expensive and complex⁴.

Well drilling regulations vary by county and groundwater conservation district, with new restrictions that can affect property development potential. Some areas that previously allowed unlimited well drilling now have restrictions that could prevent replacement of failed wells.

Agricultural exemptions provide significant property tax savings but require ongoing compliance with specific use requirements. The Texas Comptroller requires legitimate agricultural use to maintain exemptions¹⁷, and failure to comply can result in substantial tax penalties including rollback taxes with interest.

Understanding agricultural exemption requirements prevents expensive compliance issues. Properties must demonstrate legitimate agricultural use through activities like livestock grazing, hay production, or other qualifying activities. Maintaining required documentation and meeting minimum use standards requires ongoing attention and expense; just because a property is bought with an exemption attached doesn't mean it will remain.

Environmental regulations can affect property use in ways that may not be immediately obvious. Properties with wetlands, endangered species habitat, or other environmental features may face restrictions on development or modifications.

Historical or archaeological significance can create additional restrictions on property modifications. Some Hill Country properties contain historical structures or archaeological sites that may be protected under state or federal regulations.

Insurance Complications and Coverage Gaps

Rural property insurance involves complexities that don't exist with suburban properties. Understanding insurance challenges and costs prevents budget surprises and ensures adequate protection for your investment.

The Texas Department of Insurance reports that rural properties cost an average of 35% more to insure than suburban homes⁵, with additional complications related to coverage availability and exclusions. These higher costs reflect increased risks and limited emergency service access in rural areas.

March 14, 2025: fire, viewed from my personal property. There were two this day, one from a welding incident (supposedly) from a large solar powerplant and another from burning a pile of tires...

Wildfire risk has become a significant insurance consideration throughout the Hill Country. Properties in wildfire-prone areas may face coverage restrictions, higher deductibles, or complete coverage denial. Some insurance companies have stopped writing new policies in high-risk areas entirely.

Wind and hail coverage represents another challenge for rural properties. The Hill Country's exposed terrain and severe weather patterns create higher risks for wind and hail damage. Many policies have separate deductibles for wind and hail damage that can be substantial.

Flood insurance requires separate coverage through the National Flood Insurance Program, and many rural properties may need flood coverage even if not located in designated flood zones. Flash flooding can occur on any Hill Country property due to the region's topography and drainage patterns.

Distance to fire departments and emergency services affects insurance rates and coverage options. Properties located more than five miles from fire departments may face significantly higher premiums or coverage limitations.

Outbuilding coverage often requires separate consideration and may have limitations on coverage amounts or types of structures covered. High-value barns, workshops, or equipment storage buildings may require additional coverage beyond standard homeowner's policies.

Liability coverage becomes more complex on rural properties with recreational activities, livestock, or public access. Standard homeowner's liability coverage may not adequately protect against rural-specific risks.

The Financial Reality: Budgeting for Rural Property Ownership

Understanding the true cost of rural property ownership requires factoring in expenses that don't exist with suburban properties. These ongoing costs can significantly impact your housing budget and should be considered when evaluating affordability.

Utility costs on rural properties typically exceed suburban costs due to propane use, septic pumping, water treatment, and potentially higher electrical costs due to longer transmission lines. While not always the case, utility costs may be 25-50% higher than comparable suburban properties.

Maintenance costs increase on rural properties due to additional systems, longer driveways, and more extensive grounds. Professional service calls cost more due to travel time and distance. Many rural property owners develop maintenance skills or face higher ongoing expenses.

Well maintenance and water treatment represent ongoing costs that suburban homeowners don't face. Well pumps require eventual replacement, water treatment systems need regular service, and water testing should be performed annually.

Septic system maintenance requires regular pumping every 3-5 years at costs of $300-600 per pumping. Septic additives, if recommended, add ongoing monthly costs.

Property maintenance on larger rural properties requires more time and equipment. Mowing several acres requires commercial-grade equipment, and maintaining long driveways requires regular grading and material additions.

Generator systems, while not required, become essential for many rural property owners due to more frequent power outages and longer restoration times. Generator installation and maintenance add to ownership costs.

Emergency fund requirements for rural properties should be higher than suburban properties due to the potential for expensive system failures and longer repair timelines. Having $15,000-25,000 in reserves for major system failures provides peace of mind.

Due Diligence That Protects Your Investment

Successful rural property purchases require more extensive due diligence than suburban home purchases. Understanding what to investigate and when to seek professional help prevents expensive mistakes.

Professional inspections should include rural-specific specialists who understand systems and challenges unique to rural properties. Standard home inspectors may not have experience with wells, septic systems, or rural electrical installations.

Well inspections should include flow rate testing, water quality analysis, and pump system evaluation. Water testing should include bacteria, nitrates, minerals, pH, and other parameters that can affect water quality and treatment requirements.

Septic system inspections should include pumping and camera inspection of tank and distribution systems. Visual inspection alone cannot identify many septic problems that create expensive surprises after purchase.

Electrical inspections should evaluate system capacity, safety, and code compliance. Rural properties may have electrical systems that function but don't meet current safety standards or capacity requirements.

Foundation inspections become more critical on rural properties due to soil conditions and potential access limitations for repairs. Professional foundation evaluation can identify problems before they become expensive.

Environmental assessments may be warranted for properties with known environmental concerns like oak wilt, previous agricultural use, or industrial activities. Understanding environmental obligations prevents unexpected costs and liability.

Regulatory research should include current zoning, building restrictions, well drilling regulations, and any pending regulatory changes that could affect property use or development potential.

Financial planning for rural properties should include realistic budgets for ongoing maintenance, system replacements, and potential improvements. Understanding total ownership costs prevents financial strain after purchase.

Protecting Your Hill Country Investment

Buying rural property in the Hill Country offers incredible lifestyle benefits, but success requires understanding and preparing for unique challenges and costs. The families who thoroughly investigate properties before purchase are the ones enjoying their rural lifestyle years later instead of dealing with expensive surprises.

Every property has unique characteristics and potential issues. Working with professionals who understand rural properties and current regulations helps identify problems before they become expensive mistakes. The investment in professional inspections and due diligence pays for itself many times over by preventing costly surprises.

The Hill Country continues attracting buyers seeking authentic rural lifestyles, but market success requires buyers who understand the complexity of rural property ownership. Properties that receive proper evaluation and preparation provide decades of enjoyment and solid investment returns.

Understanding these warning signs and conducting thorough due diligence protects your investment and ensures your Hill Country property purchase becomes the dream you envisioned rather than an expensive lesson in rural property challenges.

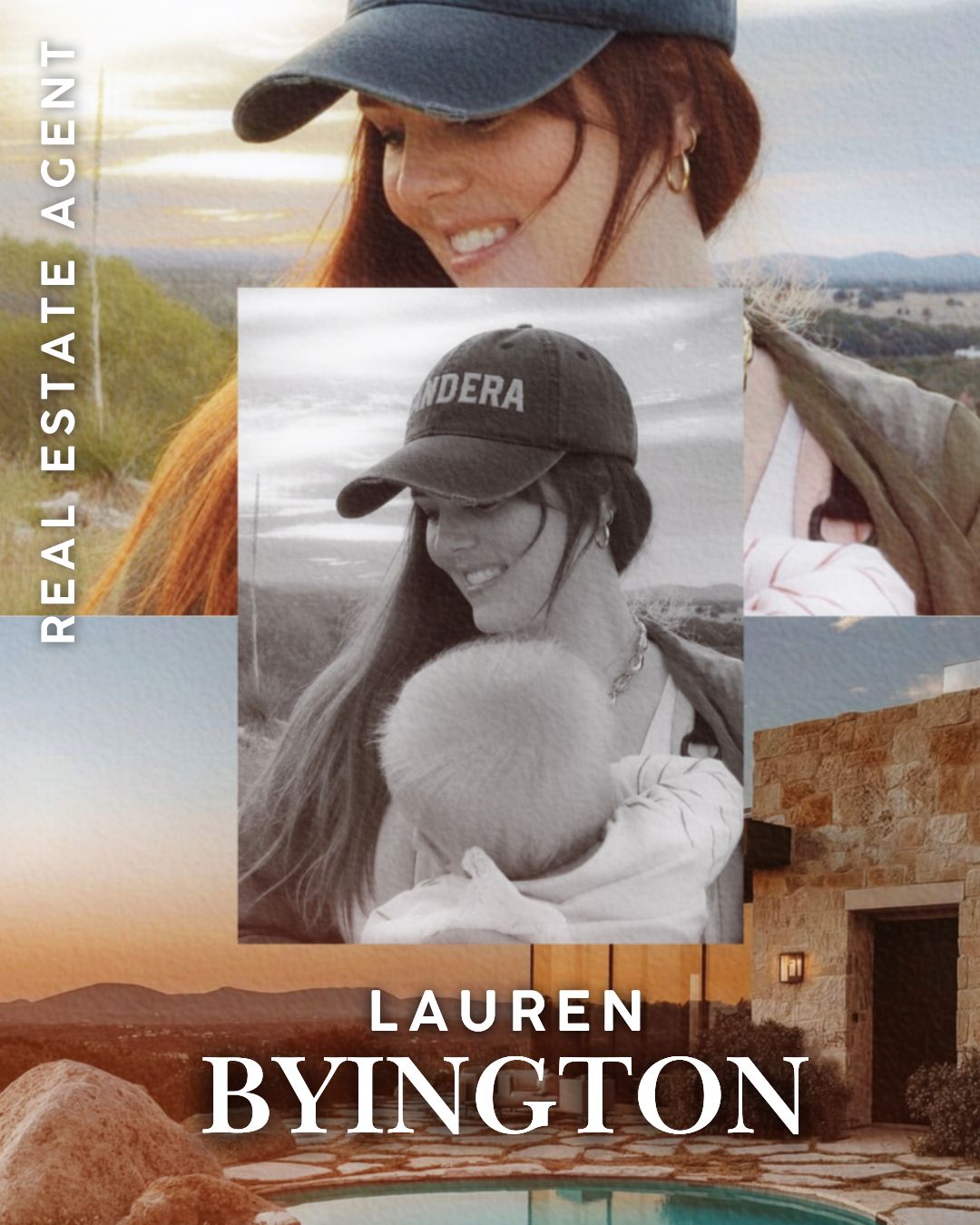

Lauren Byington is a licensed real estate professional specializing in Hill Country properties.

Contact Lauren Byington

Hill Country Real Estate Specialist

📧 lauren@hillcountryinsider.com

📱 830-556-1091

🌐 HillCountryInsider.com

Legal Disclaimer: Property conditions vary significantly between individual properties and locations. This information is for educational purposes and should not replace professional inspection and consultation. Market conditions, regulations, repair costs, and insurance requirements change frequently. Rural property purchases involve complex considerations that require professional guidance. Always consult with qualified inspectors, contractors, insurance agents, and real estate professionals before making purchase decisions. Information is deemed reliable but not guaranteed. Environmental conditions, regulatory requirements, and system performance can vary significantly between properties and over time.

0 comments